Colossa Ventures, is a SEBI registered independent venture capital management company, founded by Ashu Suyash (Former MD & CEO of CRISIL, Former India Country Head - Fidelity International, ex-Citibanker) and Vandana Rajadhyaksha (ex-Partner, ICICI Ventures and Aditya Birla Private Equity).

Ashu and Vandana set up Colossa Ventures with the strong conviction and data-backed insight that investing in ‘WomenFirst businesses’ makes immense business sense. This is underpinned by the simple fact that women comprise half

the world, they make over 75% of all decisions that any household makes, and in the last decade a significant number of women are setting up meaningful businesses across sectors. 18% of unicorns in India have at least one female

founder, and 33 women cofounded Unicorns and Soonicorns in India have already crossed a combined valuation of $30 billion. Data shows that the women founded companies' success rate is on par with their male counterparts, yet

they continue to be underfunded. External research and our survey of over 100 founders indicates that limited access to funding, market linkages, and mentorship are the top 3 challenges that come in the way of success for women

entrepreneurs. Colossa Ventures sees this milieu as a unique value creation opportunity that can deliver strong financial returns and knock on material social benefits through wider economic agency for women in India.

Colossa

Logo: The word 'Colossa', originating from 'Colossal', which represents the monumental (colossal) opportunity to invest in India's under-penetrated and undervalued women economy, bridging the large (colossal) funding gap that

exists and making a huge (colossal) difference. The logo comprises of 3 C's in a wave which represents the transformation that Colossa seeks to deliver through Capital, Capability and Confidence.

Create economic agency* and growth opportunities for women towards a more equitable sustainable India

*Agency refers to the capacity of women and girls to take purposeful action and pursue goals, free from any retribution. The three core expressions of agency are: decision-making, leadership, and collective action.

Power exceptional female founders with capital, capacity, and confidence to create enduring businesses and generate strong alpha for investors

Supporting path breaking ideas to foster a culture of innovation

Operating with openness and honesty

Encouraging perseverance and bounce-back ability however tough the going might be

Building a purposeful and supportive inclusion oriented ecosystem

Colossa deeply believes in the potential and power of women centric businesses to be the change agent towards creating economic agency for women and an in building a more equitable and sustainable world. Colossa’s primary and secondary research in India indicates that while the socio-cultural context has begun changing for the better, equal opportunity and gender balance will remain distant dreams unless there are purposeful interventions across the value chain. The Colossa WomenFirst Fund is an intervention to improve diversity in the capital allocation space. Colossa’s investment platform will go beyond the cheque through its 3-C framework – Capital, Capability and Confidence. It will not only provide capital but assist in enhancing capabilities of investee companies and bridging the confidence gap through continuous engagement and mentorship. Through this we hope to create a new asset class of enduring, high quality WomenFirst businesses where women are the key stakeholder be it as a founder, leader or beneficiary.

We provide early-stage funding to women founded/co-founded startups solving significant problems with unique technologies and scalable models. Beyond equity funding, we enable access to working capital and follow on funding through institutions, investment banks, co-investors and other funds.

Colossa supports the growth and development of women entrepreneurs by providing access to resources, networks, training, and coaching. We connect founders with mentors, experts, and peers for guidance on business operations and scaling. Collaborations with institutions help create market linkages and facilitate research and innovation for women-led businesses.

Through mindful mentoring, Colossa empowers women entrepreneurs to overcome challenges and biases. We celebrate their achievements and showcase their stories to inspire more women to pursue entrepreneurship. We also foster a supportive community where women can share experiences, build resilience, and gain the confidence needed to succeed in their entrepreneurial endeavors.

Startup evaluation and access to resource groups

Startup evaluation and access to resource groups across engineering and healthcare disciplines

Startup evaluation and access to resource groups

Legal Matters and Due-Diligence

Compliance and legal matters

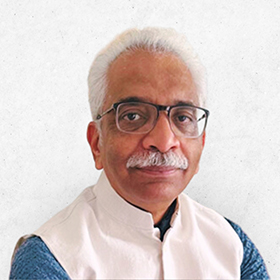

Founder & CEO

Ashu is a successful leader with over 3 decades of experience in Indian financial services and the global information services sector. She is currently the Founder & CEO of Colossa Ventures, a unique investments ecosystem that powers women-focused businesses with capital, capability, and confidence building. Colossa’s first fund, Colossa WomenFirst Fund, aims to invest in disruptive, category-defining, scalable businesses founded/co-founded by women entrepreneurs.

Ashu is an independent director on the Boards of Hindustan Unilever Limited, Kotak Mahindra Bank Limited, Tata Elxsi, and the National Institute of Securities Market.

Prior to setting up Colossa, Ashu was the Managing Director & CEO of CRISIL Limited (2015-2021), and a member of the Global Operating Committee of S&P Global Inc. She was instrumental in CRISIL’s transformation from an analytical services company to a leading, global, data analytics and solutions company.

Ashu’s previous roles were as CEO of L&T Investment Management Limited and L&T Capital Markets Limited, and as the Country Head and Managing Director of Fidelity’s Indian Mutual Fund Business, a business she helped

set up and grow. She started her career with Citibank India where she held several key positions across their corporate and investment banking group.

Ashu is a strong sponsor of governance and best practices, and cares deeply about economic agency for women, affordable healthcare and right to education for all. She is a member of several Associations

and Committees in these areas. Ashu has received several awards and has been recognised among the Top 50 Women in business in India. She is a Chartered Accountant and holds a bachelor's degree in commerce from

University of Mumbai.

Founder & Co-Head

Vandana Rajadhyaksha - She has a career of over two decades across manufacturing, consulting and investment management. Having spent over 21 years in Venture Capital and Private Equity industry, Vandana has established herself as a distinguished investment professional. She has adeptly overseen portfolios surpassing USD 300 mn Cr across various sectors, significantly enhancing their value and delivering top quartile returns to her investors. Vandana has been successful in identifying opportunities ahead of the curve and led transformative investment strategies as Investment Director, ICICI Ventures and Director (Investments) at Aditya Birla Private Equity. She laid the foundation for Aditya Birla Ventures and has been working with startups as an independent consultant assisting them in strategic initiatives and raising funds. Her investment expertise spans the financial services, consumer, healthcare and technology sectors.

Her representation on the boards of companies such as Infoedge, ShriramCity, Olive bar and Kitchen and IEX underscores her pivotal role in fostering growth and ensuring profitable exits.

Now, as Co-founder

of Colossa Ventures, Vandana leverages her extensive network and profound understanding of the Venture Capital Industry to advise stakeholders in the private markets. Her investing acumen and global connections

continue to position her as a formidable leader in the venture capital industry.

Farida Khambata

Harinarayan Sharma

Raghu Cavale

Ruchi Kalra

Shantanu Deshpande

Shrestha Chowdhury

Deploying venture growth capital into disruptive, category-defining, WomenFirst, climate and inclusion businesses through a meticulous and rigorous process. We will look to back exceptional founders and accelerate growth via Colossa 3C Framework.

April 15, 2025

Centa, a teacher accreditation-linked edtech startup, has raised ₹20 crore in a funding round led by Mumbai-based venture capital firm Colossa Ventures. Read More

Sep 10, 2024

Cleantech startup Exposome has secured INR 15 Cr ( around $1.7 Mn) as a part of its Pre-Series A funding round led by Colossa Ventures. Read More

Mar 29, 2023

Serigen Mediproducts, an innovative medical products company with a pioneering portfolio of silk protein-based products, has successfully raised INR 5. Read More

Feb 16, 2023

Vioma Motors has developed an indigenous smart electric two-wheeler offering a range of about 400km on a single charge. Read More

Feb 18, 2023

Colossa Ventures LLP, focusses on investing in ‘women-first’ businesses,, leads the Pre-Series A round in Vioma Motors, an e-mobility startup, garneri Read More

Mar 7, 2024

Colossa Ventures has secured ₹100 crore from Ranjan Pai’s family office, , and other investors for its maiden fund—which it said has been designed to back “women-first” businesses. Read More

Mar 7, 2024

On the eve of International Women’s Day, Colossa Ventures, a SEBI registered venture capital management company, has announced the first close of its maiden fund - Colossa WomenFirst Fund at ₹100 crore. Read More

Mar 8, 2024

Mumbai-based venture capital firm Colossa Ventures intends to raise the entire Rs 500 crore for its maiden fund in the next 18-24 months, for which it is in discussions with a host of Indian and global institutions. Read More

MUMBAI: Colossa Ventures, a venture capital management firm, on Thursday said it has raised Rs 100 crore for its maiden fund with a target corpus of Rs 500 crore. Read More

Mar 8, 2024

Colossa Ventures has announced the first close of its maiden fund – Colossa WomenFirst Fund at INR 100 crore.It received funding from entities, including SIDBI, the family office of Ranjan Pai, and Shriram Ownership Trust, among others. Read More

Mar 7, 2024

Colossa Ventures has raised Rs 100 crore as the first close for its maiden WomenFirst Fund as it aims to invest in startups that are founded or co-founded by women, and also include those where they are the main beneficiaries. Read More

Mar 7, 2024

Women entrepreneur-focused venture capital firm Colossa Ventures, which was floated by former executives of Crisil and Aditya Birla Private Equity, Thursday said it has made the first close of its maiden fund. Read More

Mar 7, 2024

Mumbai-based venture capital firm Colossa Ventures has marked the first close of its maiden women-focused fund at INR 100 Cr ($12 Mn).The fund, Colossa WomenFirst Fund, with a target corpus of INR 500 Cr, mainly invests at the pre-Series... Read More

A SEBI-registered independent venture capital management firm, Colossa Ventures has declared its first funding close, Colossa WomenFirst Fund on Rs. 100 crore. Read More

Mar 7, 2024

Colossa Ventures, an independent venture capital management company, announced on Thursday that it raised Rs 100 crore at the first first close its Colossa WomenFirst Fund.First close refers to the initial round of investors making capital commitments in a private... Read More

Mar 7, 2024

Colossa Ventures, a SEBI-registered independent venture capital management company, has announced the first close of its maiden fund – Colossa WomenFirst Fund at Rs 100 crore. Read More

Mar 7, 2024

SEBI-registered independent venture capital management company Colossa Ventures has announced the first close of its maiden fund - Colossa WomenFirst Fund at Rs 100 crore, it announced on Thursday. Read More

Mar 7, 2024

Mumbai, Mar 7 (PTI) Colossa Ventures, a venture capital management firm, on Thursday said it has raised Rs 100 crore for its maiden fund with a target corpus of Rs 500 crore. Read More

Mar 8, 2024

Colossa Ventures, a SEBI registered independent venture capital management company, founded by Ashu Suyash (Former MD & CEO of CRISIL, Former India Country Head - Fidelity International, ex Citibanker) and Vandana Rajadhyaksha (Ex-Partner, ICICI Ventures and Aditya Birla Private Equity).. Read More

Mar 8, 2024

On the eve of International Women’s Day, Colossa Ventures, a SEBI registered independent venture capital management company, founded by Ashu Suyash (Former MD & CEO of CRISIL, Former India Country Head – Fidelity International, exCitibanker) and Vandana Rajadhyaksha... Read More

Mar 8, 2024

On the eve of International Women’s Day, the Mumbai-based SEBI registered venture capital management company, Colossa Ventures led by Ashu Suyash and Vandana Rajadhyaksha, has declared the first close of its maiden fund – the Colossa WomenFirst Fund, securing INR 100 Crore. Read More

Sept 10, 2024

Cleantech startup Exposome has secured INR 15 Cr ( around $1.7 Mn) as a part of its Pre-Series A funding round led by Colossa Ventures. Read More

March 29, 2023

Serigen Mediproducts is an innovative medical products company developing nextgen tissue repair solutions. The startup will utilize the funding for development of its product portfolio, team expansion and for strengthening its intellectual property portfolio. Read More

Feb 16, 2023

Mumbai: Colossa Ventures LLP, which focuses on investing in ‘women-first’ business leads the Pre-Series A round in Vioma Motors, an e-mobility startup, with 10% stake. Read More

Feb 18, 2023

Colossa Ventures LLP, focusses on investing in ‘women-first’ businesses,, leads the Pre-Series A round in Vioma Motors, an e-mobility startup, garnering a 10% stake. BRTSIF, the existing investor, is also expected to participate in this round. Read More